Home » Navigating the Complex World of Transaction Regulatory Reporting for FinTechs

INSIGHTS

Intelligent solutions. Informed decisions. Unrivaled results.

Navigating the Complex World of Transaction Regulatory Reporting for FinTechs

Transaction monitoring is "the process of reviewing, analyzing and administering the transactions processed on a business application or information system". It is extremely critical for Asset Managers, Hedge Funds, Banks, and Financial Institutions for downsizing risks in a volatile market and ensuring that the most stringent regulatory requirements are met.

Considering recent fiascos such as Silvergate and Silicon Valley Bank and the Black Monday of 2020 when global stock markets crashed on 16 March, and US stock markets suffered from the biggest single- day fall since the 1987 crisis, there is a lot at stake for Portfolio Managers, Asset Managers, and Financial Institutions as situations such as the above could have far-reaching consequences and create a negative ripple effect.

While Silvergate and Silicon Valley Bank suffered an ignominious ending, the Black Monday of 2020 resulted in banks and reserves globally cutting their interest rates and bank rates and offering unprecedented support to investors so that a repeat of 2008 would not happen.

Decoding the challenges faced by Asset Managers and Financial Institutions

Regulatory compliance: From a regulatory perspective, banks, investment firms, and asset managers must comply with certain transaction-based regulatory standards like the Money Market Statistical Reporting (MMSR) Regulation, the Markets in Financial Instruments Directive II/Regulation (MiFID II/MiFIR), European Market Infrastructure Regulation (EMIR), and the Securities Financing Transactions Regulation (SFTR). For banks and financial institutions, failure to monitor and report in a timely manner could result in massive penalties and further corrode their reputation.

Bogged down by bad data: However, monitoring and reporting in a timely manner is not easy. Asset Managers, Banks, and Financial Institutions are bogged down by many challenges, particularly those related to data. The data collected by old and archaic systems are constrained and rules/scenarios are not applicable or fail to produce the desired results. Banks and Financial Systems must also counter the fact that data is generally of poor quality – that is incomplete and inaccurate. With data emerging as the mainstay of an effective transaction monitoring system, inevitably, there is a lot that must be done to ensure accuracy, consistency, and fewer false positives.

Tackling potential disruptions quickly: Whether a Bank or an Asset Manager, they must make a case for dynamic transaction monitoring for gaining insights quickly so that potential scenarios can be tackled quickly. However, when they are burdened with humongous amounts of false alerts, monitoring becomes a challenge, and banks and financial institutions either need bigger teams or smarter technology and AUTOMATION.

Other challenges: Some of the other micro and macro challenges faced by Asset Managers and financial institutions today when it comes to regulating and streamlining transaction monitoring are:

- Lack of standardization in the labelling of data.

- Incompleteness of regulatory data information as per business need.

- Monitoring and controlling data quality issues.

- Lack of expertise for the implementation of regulatory requirement workflow in the financial system.

- Managing the regulatory database and monitoring streamlined data flow

- Reconciliation and distribution of feedback status from NCA, ARM to the Client.

How Big is the Risk? For Banks and Asset Managers

- In 2018, the US Bank National Association of Cincinnati, Ohio, (U.S. Bancorp) was fined $598 million. There were deficiencies in its AML program. To quote the experts, "systemic deficiencies in its transaction monitoring systems, which resulted in monitoring gaps…” It had among many deficiencies “outdated systems to conduct appropriate monitoring and due diligence.”

- Similarly, we can also consider the example of UBS which was fined $15 million for weaknesses in its automated monitoring system that resulted in poor monitoring or less than thorough monitoring of wire transfers by FinCEN in 2018.

- The worst single-day dip in the stock market happened on 16 March 2020, when the Dow Jones plunged by 2,997 points (earlier, on 9 March, there was a dramatic 2,014-point drop in the Dow Jones Index was followed by two more drops of 2,353 points on 12 March). This could have easily led to a seismic shock in the stock market, but a repeat of 2008 did not happen through the bullish phase of the stock market came to a halt.

In all the stories that have been mentioned above, we can observe a common thread, the regulators coming down heavy on banks and financial institutions for failing to meet the regulatory standards- and the chief culprit - an outdated and archaic mechanism that is unable to cope up the fluctuations in the market. When it comes to trading and stock market fluxes due to unforeseen circumstances, handling the spike in guideline violations, or emails can be tricky but with automation and a post-trade monitoring workflows that incorporate multiple levels of alerts, we can be

Today, as risk management teams are spending more than 10 % of the revenue on compliance adherence and regulatory announcements associated with fraud and Anti-Money Laundering (AML) have increased by more than 500% globally, there is increasing pressure to de-risk with automated and Artificial Intelligence and Rules-based solutions. And this is where a tool like Magic DeepSight TM comes in. A highly proficient rules-based data extraction platform that leverages technologies like artificial intelligence, and machine learning to provide massive (70% cost savings), exceptionally higher data accuracy, while streamlining your internal and regulatory transaction monitoring workflows and navigating the complex world of transaction monitoring with ease.

Automation, Rule-based, Process Standardization, and Data-Centricity – The Key Levers of Smarter Transaction Reporting

Automation is the key to keeping up to date and ensuring timely resolution of the alerts and triggers thereby saving time, money, and manpower and ensuring quality and standardization. Here's how processes can be streamlined.

Magic FinServ raising the bar with DeepSightTM

- For comprehensive data transformation (and delivery), firms can count on Magic DeepSight™ for the delivery of results within a shorter span of time and from the widest range of data sources. DeepSightTM aggregates data from different sources (websites). It trawls different websites and identifies the data (for example corporate actions) and downloads it. DeepSight TM extracts only the relevant information from the massive amount of information available, saving considerable time in comparison to manual work. Thereafter, data is reconciled with a static database. In the process, data is transformed - and a Golden Copy dataset for all static data related to the customer account and securities is created.

- When it comes to process optimization, the capability of Magic DeepSight TM in bringing the required changes is immense. Process standardization, wherein a standard workflow is defined in sync with the business solution. The approach also involves defining a standard template and creating artifacts and documents for tracking and monitoring the regulatory workflow.

- DeepSightTM adopts a rules-based approach which makes the extraction of data more relevant. Business Rule engine implementation is another critical lever or pillar for streamlining transaction monitoring and reporting and ensuring transparency in pre- and post-trade and email reporting. For defining and implementing the business rules, the reference comes from the Regulatory Technical Standard (RTS), XML schema released by Regulatory Authority bodies such as the ESMA.

- DeepSightTM can be easily integrated with custom and industry platforms, so firms do not have to waste time figuring out how to do it. Lastly, a standard workflow for the Audit and Status report incorporation based on the feedback/acknowledgment received from the NCA enables another critical milestone - last-mile process optimization – without which the actual benefits of automation cannot be reaped.

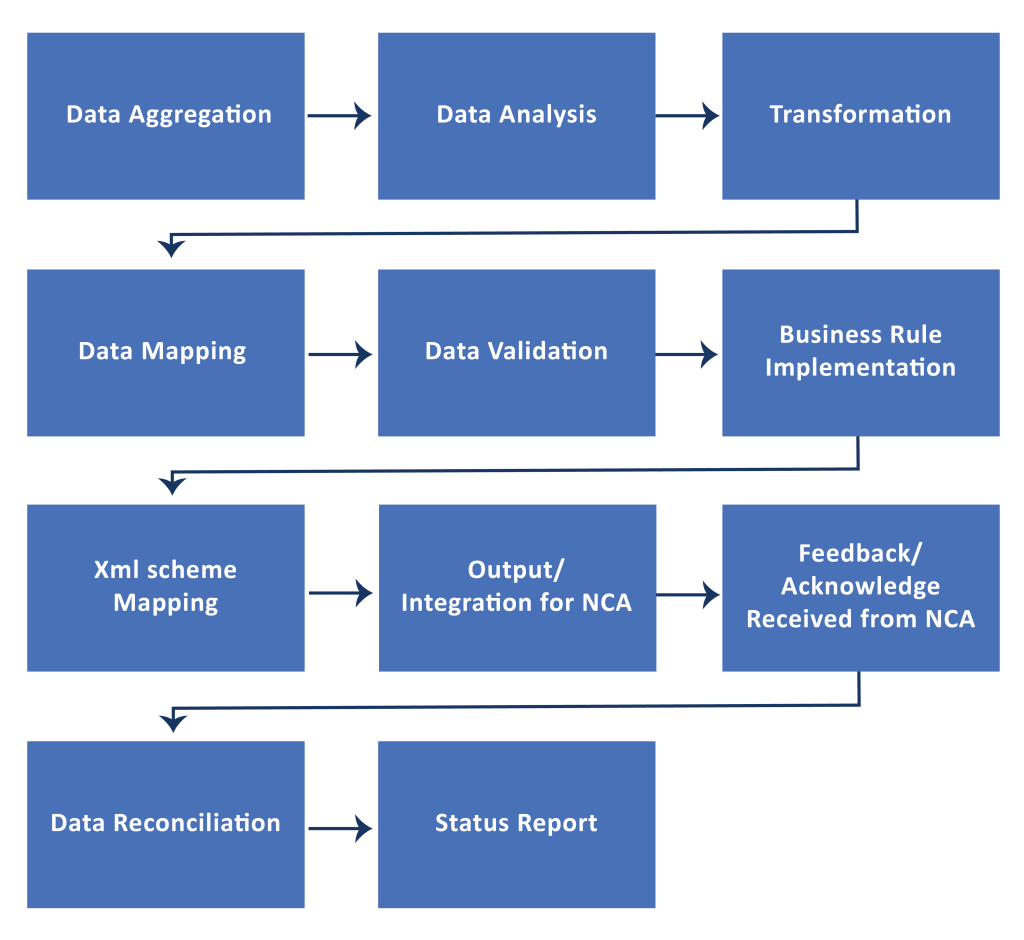

- Below is a pictorial depiction of how Magic FinServ enables compliance and transparency of post-trade and email transactional regulatory reporting business MiFD II, SFTR - data as per ESMA with a data- centric, automated, and rules-driven solution for one of our clients.

Regulatory Reporting Business Process

Case Study: Ensuring System Integration for Back Office Automation Rollout for our Client

One of our clients is involved in all the post-trade transaction regulatory reporting business (MiFID II, SFTR, email, etc.). All the post-trade transaction data must be per the regulatory body ESMA. ESMA provides guidelines on how an asset manager must send all post-trade information to regulatory bodies, for ensuring transparency of business in terms of email reporting, MiFID II reporting, SFTR, etc. We implemented a solution where we got the information (data) from the customer and mapped the data to the XML schema, which is provided by ESMA. Thereafter, all the information defined in XML schema is shared with the NCA, the regulatory body for validation. The body decides whether it is correct or not. If data is missing, they revert to asking for more information to ensure that the regulatory needs are met.

Conclusion: What is in it for you?

Magic FinServ is an apt partner in your automation journey. We can help firms leverage their automation plans related to transaction monitoring with our incisive approach to data and process optimization. Here is how we do it:

- Understand the problem statement for filing transaction regulatory reporting

- Comprehend why is it that the organizations are not able to file

- Is it a data problem - incompleteness of data, or,

- lack a standard process or,

- firm lacks the ability to understand the regulatory process

- Based on the inputs, we define a roadmap

- Then either use automation tools or develop internal automation tools on one's own for streamlining the transaction regulatory monitoring. The biggest advantage is that Magic FinServ brings the technology to automate some of the processes that are extremely time consuming. Our bespoke tool takes away the pain navigating complex transaction monitoring (internal and regulatory). DeepSight TM is purpose-built for the financial domain and can meet the strictest standards to ensure streamlined operations (monitoring and reporting).

- As it integrates seamlessly with platforms both custom-made and industry-leading, it obliterates needless work and ensures smooth workflow across business applications; with the capability to scale up or down as per the need.

- Magic Deepsight™ pre-configured exception-handling rules weeds out errors more proficiently than before.

For more information on how we can add more value to your transaction monitoring, with our solutions you can write to us mail@magicfinserv.com.