Home » Are you ready for Sec T+1 Settlement reforms?

INSIGHTS

Intelligent solutions. Informed decisions. Unrivaled results.

Are you ready for Sec T+1 Settlement reforms?

Enhancing Broker and Dealer Transition to new Sec T+1 Settlement with AI/ML Intelligent Data Automation Solution

In trading, time is of the essence, as every moment wasted in settling or reconciling a trade incurs higher costs and greater risks. Today, as the US proposes a shift to the T+1 settlement cycle, the primary objective is reducing the time it takes to settle a trade. And in the process, decrease the risks. That seems justified as the markets have experienced severe shockwaves in the last two years, due to market volatility, pandemic, fall of meme stocks, etc.

The T+1 settlement cycle essentially means that all settlements relative to trade must be carried out the next day and is expected to yield benefits like reduced costs, increased market efficiency, and reduced settlement risks.

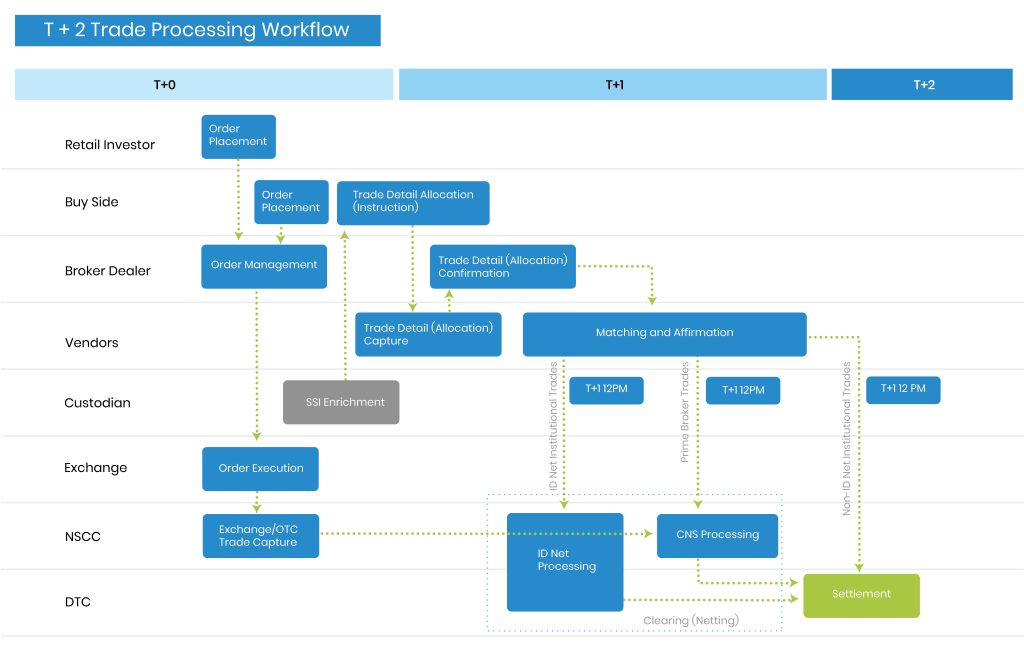

So, while earlier, the settlement cycle (t+2) looked like this:

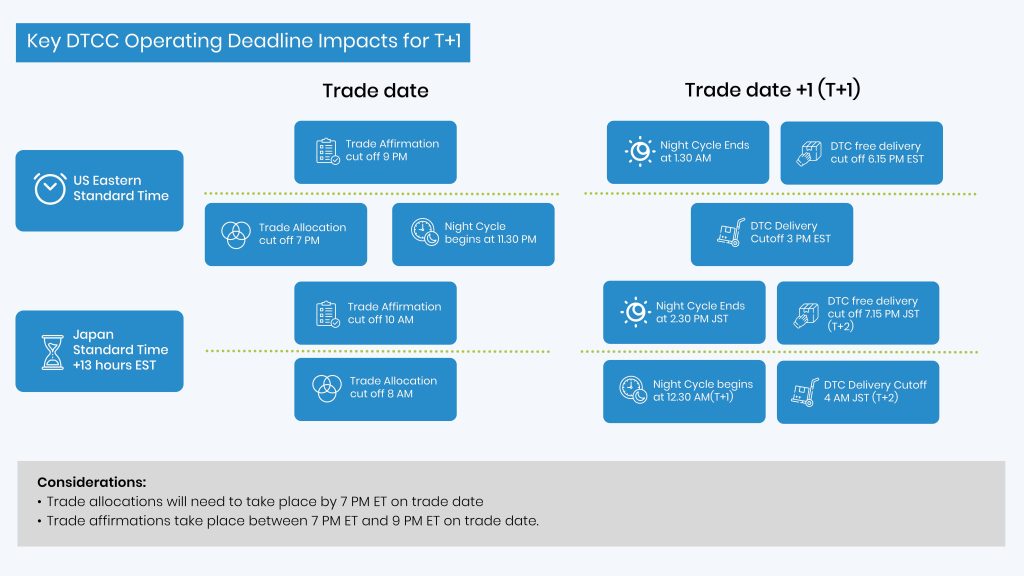

Now we have a settlement cycle (T+1) that looks like the one below:

Implications of Transition T+1: Unveiling the Key Challenges in Broker-Broker (Executive and Clearing Brokers) Communication

Though the transition to T+1 provides multiple benefits, the shift from T+2 to T+1 is not easy. We elucidate this using the example of brokers/dealers, who are a vital part of the trading chain. T+1 settlement of institutional trades lowers margins for broker/dealers. Brokers are required to pledge cash and securities to a clearing house, benefit enormously from the lower margin requirements (difference between the current value of the security offered the collateral and the value of loan granted). But it is not a win-win situation for them yet.

One of the biggest challenges in transitioning to the T+ 1 settlement cycle is the lack of automation in any communication emanating between broker-broker or the Executing Broker and the Clearing Broker when it comes to Trade File Processing. This broker-broker communication is centrally a part of the back-and-forth information processed by the middle office (MO) and settlement information/status received from the Clearing House or Back Office (BO)system.

Another significant challenge is the reconciliation of trade files and other reports. Without automation, manually updating these details, typically in Excel or spreadsheet format, can be quite cumbersome. The executing broker shares trade details with the clearing broker, usually in the form of spreadsheets, which are then processed and imported by the analyst team into the clearing system.

When investment manager, broker-dealer, clearing dealer rely more on manual processes than automated, time lags and delays are bound to happen as everything happens sequentially instead of bi- directionally. With automated processes, the majority of trades can be processed on the same day without requiring manual intervention.

Markets and prices are in a state of flux when it comes to trading. Hence, broker dealer, clearing broker must always be in a state of alert. Even remote chances of error or trade fails must be rooted out, unfortunately with manual mistakes that can have major consequences are higher.

Additionally, there are other unresolved issues such as:

- Manual entry of data from documents received via email or fax from the investment manager when a trade is blocked. There is also a substantial amount of manual effort involved in the reconciliation and communication between the executing broker, the clearing broker, and other parties, for final clearing and settlement that must be automated for ensuring SDA(Same Day Affirmation).

- There is still a substantial amount of paper involved

- Sliced, dicing, and digesting the unstructured data in emails and faxes in time for T+1

- Most firms are burdened by a crumbling legacy architecture that cannot scale up fast enough. If that were not concern enough, building a new one that could ensure adherence to t+1 from scratch would be time-taking and excessively expensive.

- For (T+1), broker/dealers and clearing broker must speed up affirmations, confirmations, and allocations processes. But how do they do that when they have not yet automated their processes and there is no STP.

So better late than never! We are here to help firms navigate the transition to T+1, by redefining and re- strategizing the options and integrating our magical solution DeepSightTM that leverages the power of AI and ML to ensure a win-win. But first here's a brief on T+1:

Automation is pivotal for T+1: How AI/ML and RPA helps reach the magical Same Day Affirmation (SDA)

The biggest challenge for T+1 transition is the lack of automation in institutional “allocations and affirmations.” This is one area that requires massive transformation to achieve the proposed settlement cycle timeframe. An automated solution can play a crucial role in facilitating same- day affirmation (SDA) processes for broker-dealers and clearinghouses.

With automation, broker-dealers and clearing houses can also:

- Reduce the risk: As the volume of unsettled trades over a single trading day and the time between trade and settlement are reduced, counterparty, system-related, and operational risk is reduced.

- Trade capture and validation: Perform real-time validations, ensuring that trades meet pre- defined criteria and are eligible for SDA.

- Enables seamless transition: By automating various aspects of the settlement workflow, broker- dealers and custodians can minimize manual intervention, reduce operational risks, and enhance overall operational efficiency.

- Eliminates the need for manual intervention and errors: Eliminating the need for manual intervention and reducing the risk of trade discrepancies.

- Exception handling made easier: Automatically identify and flagging trades that require manual intervention. focuses on the resolution of exceptional cases promptly, paving the way for smoother SDA processes.

- Seamless data validation and reconciliation: Validate trade data and reconcile it with external sources, such as market data providers or reference databases.

- Prompter resolution of errors: Potential discrepancies or errors can be identified and resolved promptly, reducing risks associated with inaccurate or incomplete data.

- Enables straight-through processing: Eliminates the need for manual rekeying or intervention at different stages.

Revolutionizing T+1 Settlement: Empowering Broker-Dealers and Clearing Houses with DeepSightTM

Now is the time for broker dealers and clearing houses that have not yet implemented automation to take to aggressively pursue automation if they are to abide with the proposed new rules. For broker dealers and clearing houses, the focus would be on ensuring SDA.

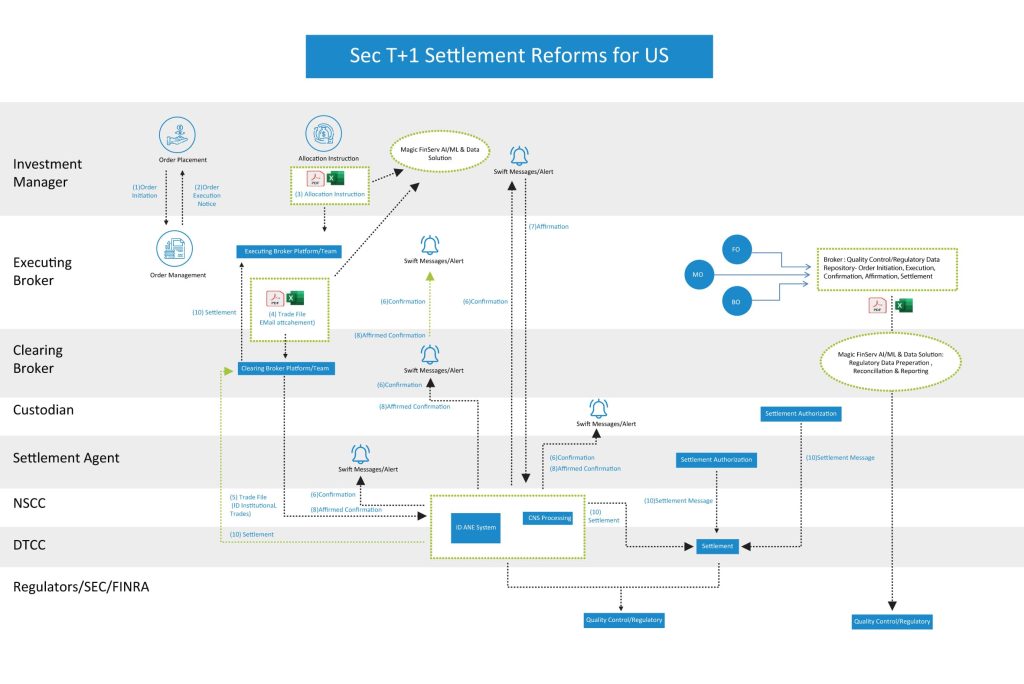

Here's how Magic FinServ's AI Optimization framework – DeepSightTM that has at its core AI/ML and Data builds tailored solutions that reduce the need for human intervention stoking up processes and ensuring optimal levels of efficiency for processes related to confirmation, allocation and affirmation and trade matching.

Magic FinServ's innovative digital solution leverages the power of data and AI/ML technology to standardize business processes related to trade file processing by automating the broker-broker communication. Our highly intelligent and scalable solution shifts through data sources in different formats: Excel/spreadsheet/CSV files/Email body/Email attachment/API integration from multiple systems/ and other unstructured formats with ease and creates the "Reconcile Report" for other market player. It also supports the setup of the Golden Copy Data Management for multiple other sub activities related to the trade lifecycle. Other aspects of our solution include - Exporting the reconciled trade file, configuring any Business Rule/Mathematical rule which is required for generation of trade file, and generating reports based on customer need, i.e., in JSON, API, excel or any standard template.

While DeepSightTM can help automate processes, the move to T+1 settlement will still require fundamental changes throughout the trade processing lifecycle.

- Consolidation of data feeds between new and legacy systems to centralize data management.

- It is necessary to adopt technology (e.g., DTCC’s ITP CTM) and/or messaging protocols (e.g., FIX) to automate the communication of allocations and CTM’s Match to Instruct to facilitate more timely trade affirmations.

- As firms move to T+1 settlement, they must adopt technology (e.g., DTCC’s ITP CTM/M2i) and/or messaging protocols (e.g., FIX) to automate the communication of allocations.

The Incredible Benefits of DeepSightTM

When broker-dealers, whether they are small boutique firms or subsidiaries of investment banks, consider their options, they can reap several benefits.

Eliminate the friction: Firms can eliminate the friction that exists at multiple touchpoints when data is entered manually. They can leverage the AI/ML capabilities to extract relevant data from documents, pdfs, mails/faxes, etc.

Fasten the post-trade agreement and affirmation by almost 50%: A solution like DeepSightTM can scale quickly and is ideal for periods when trade volumes are high or market volatility is high or both, as it trained to extract the appropriate data from the swathes of information available infinitely faster than humans.

Benefit from data-driven approach: Trade is ultimately about data. As the data experts, we can quickly identify which are the processes that would require automation. So, whether investment managers/portfolio managers who need help analyzing their performance or peers and counterparties/broker-dealers, custodians, our solutions can ensure that the transition to T+1 is smoother.

Reduce operational risk: With standardization and STP, operational risks are reduced considerably. When organizations opt for a solution like Magic Deep Sight, that leverages the power of AI and ML, and that can be easily integrated with existing systems, allocation, conformation, and central matching is given a boost. With SDA, firms can easily ensure the next day's settlement.

Reference data management: Reference data management is a critical part of data management. To ensure transparency and efficiency, firms must update their reference data (e.g., the asset type, counterparty information), security pricing data, and standardized settlement instructions (SSIs). With DeepSightTM , the processes are streamlined and there is no chaos.

Easy and seamless integration with legacy architecture and workflows: No need to replace legacy: DeepSightTM biggest advantage is the heuristic approach wherein firms do not have to replace the existing workflows, as our solution can be integrated with traditional workflows and legacy architecture.

Exception Management: This metric assesses the ability to identify and resolve exceptions or discrepancies promptly during the settlement process. Efficient exception management helps streamline operations, reduces manual intervention, and enhances overall settlement efficiency.

Conclusion: A Shorter Settlement Cycle Benefits All!

Shorter settlement cycles benefit all. Some of the benefits are:

Shorter settlement cycles benefit all. Some of the benefits are:

- Improved straight-through-processing (STP)

- Quicker settlement

- Less margin required

- Reduction of operational and systemic risk

- Decrease in costs and resources from reduced number of unsettled positions

Irrespective whether it is an investment manager, broker dealer, clearing dealer or clearing house, custodian, or settlement agent, T+1 is good for all. Ideally, T+0 settlement cycle offers the best deal; however, it would require a massive overhaul of the existing architecture, hence the SEC and other regulatory bodies have opted for transition to T+1 for the time being. Though some amount of re- strategizing is required to get in sync.

By embracing automation and STP, broker-dealers and custodians can enhance their operational resilience, reduce settlement risks, and improve client experience. They can focus on value-added activities and provide faster and more efficient services to market participants. If there is more that you would like to know as a broker dealer or clearing house, you can drop a mail at mail@magicfinserv.com